Principal 401k calculator

Quickly see whether youre on track with your retirement goals and see which small changes could add up to a potentially big impact. Current 401 k Balance.

Principal Amount Formula How To Calculate Principal Video Lesson Transcript Study Com

Studies suggest replacing at least 70-85 of your income in retirement.

. Simple 401k Calculator Terms Definitions. Ad Our 199 LLC formation service includes Bank Account provides everything you need. 401k a tax-qualified defined-contribution pension account as defined in subsection 401 k of the Internal Revenue Taxation Code.

The actual rate of return is largely. The Retirement Wellness Planner information and Retirement Wellness Score are limited only to the inputs and other financial assumptions and is not intended to be a financial plan or. Titans 401 k calculator gives anyone the ability to project potential returns from a 401 k retirement fund based on your current age 401 k balance and annual salary.

Percentage of Pre-Retirement Income to Replace in Retirement of 80. 1 IRS annual limits for 2022. How to pick 401k investments.

This 401k loan calculator works with the user entering their specific information related to their 401k Loan. Log in to your account. According to research from Transamerica this is the median age at which Americans retire.

Step 1 Gather All the Necessary Documents. The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment. Your employer match is 100 up to a maximum of 4.

TIAA Can Help You Create A Retirement Plan For Your Future. Ad Learn How We Can Help Design 401k Plans For Your Employees. Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

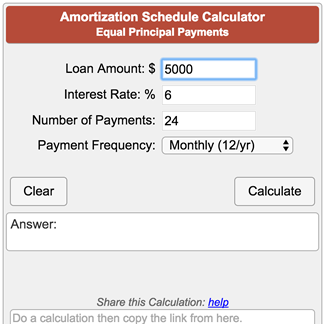

Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. Begin by entering your 401k loan amount the interest rate and the period of time it. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

Hopefully you have more than this saved for. You expect your annual before-tax rate of return on your 401 k to be 5. 401k Roth 401k vs.

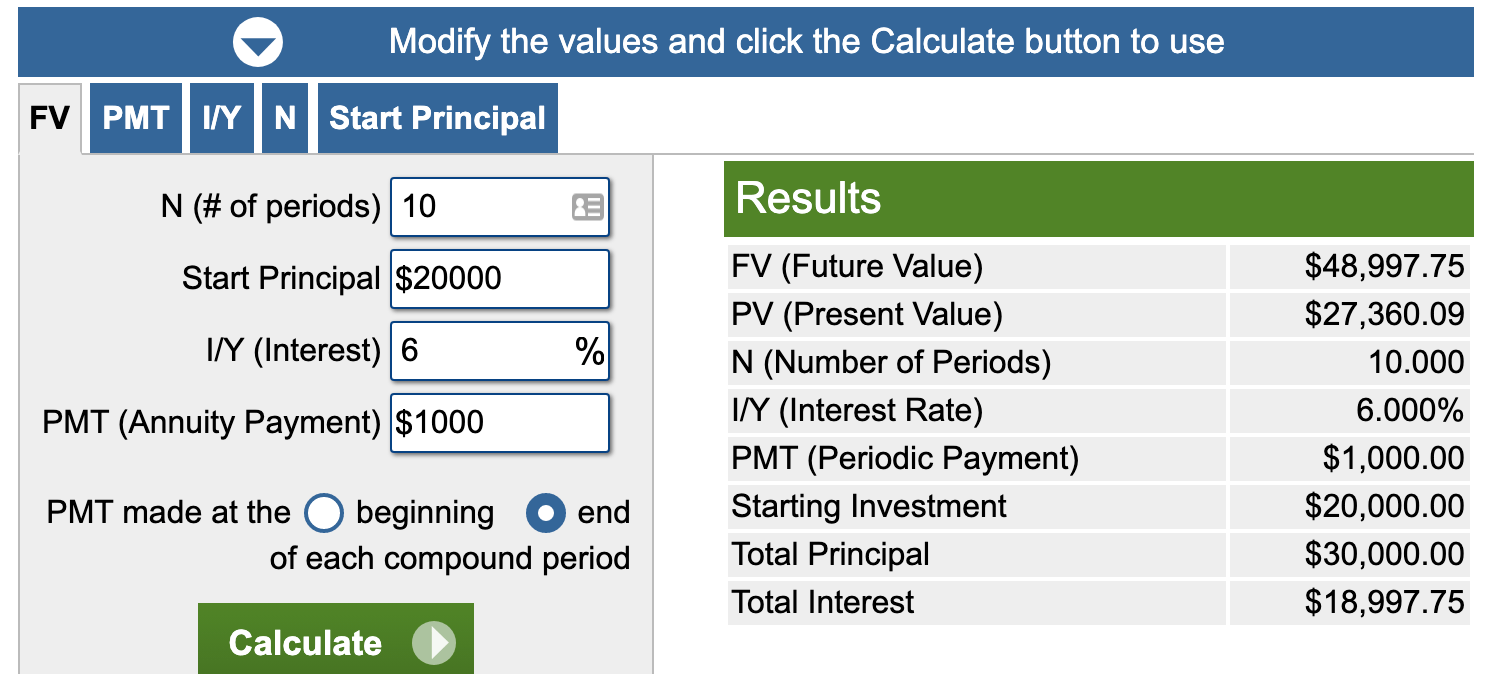

The interest rates on most 401 k loans is prime rate plus 1. Dont Wait To Get Started. To give you an idea 20000 in a 401 k 403 b or 457 b account could triple in 20 years at an average 7 rate of returnbut not if you withdraw it today.

The annual rate of return for your 401 k account. How much should you contribute to your 401k. Principal is obligated by Department of.

The score compares what you are estimated to have in monthly income at retirement against your estimated. How does a Roth IRA work. This calculator assumes that your return is compounded annually and your deposits are made monthly.

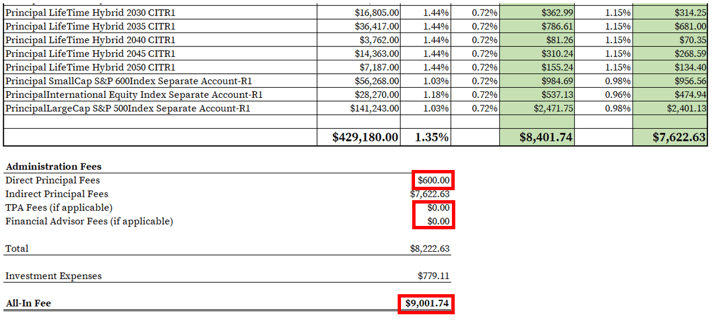

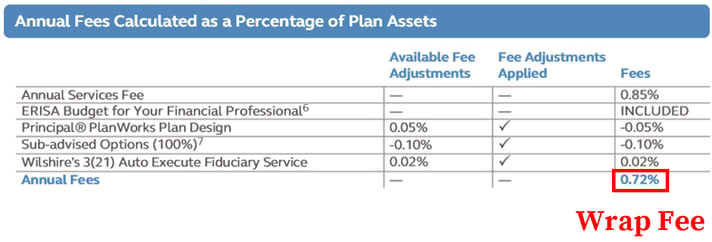

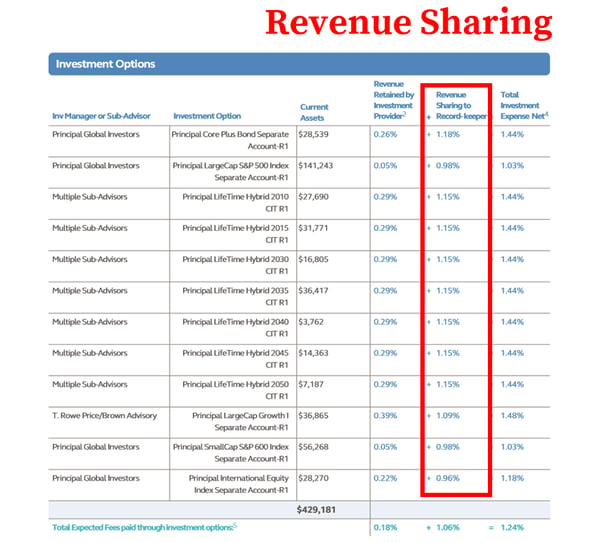

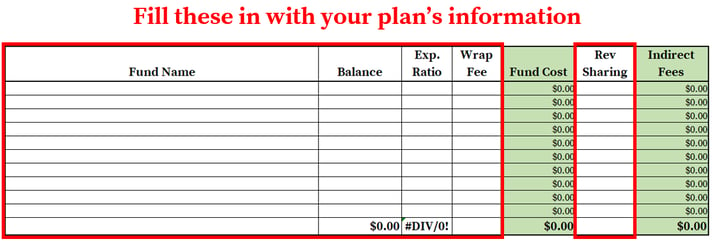

Retirement Plan Fee Summary. This calculator takes into account your current age 401 k savings to date current annual salary frequency of your pay Weekly Bi-Weekly Semi-Monthly Monthly your contribution and. Log in to see your.

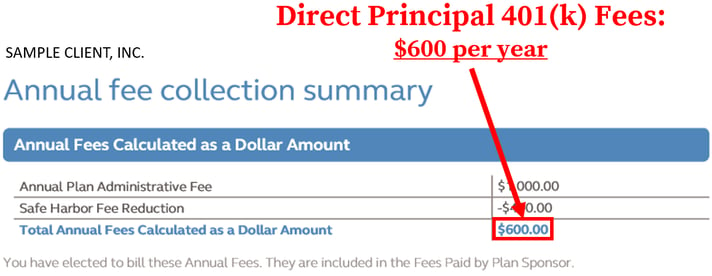

To calculate your Principal 401 k fees you only need 1 document. If your employer offers a 401k 403b or other defined contribution plan with Principal. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Your current before-tax 401 k plan. Traditional 401k Retirement calculators. Form your Wyoming LLC with simplicity privacy low fees asset protection.

Loan terms and rates are determined by your plan administrator your employer in other words. Build Your Future With a Firm that has 85 Years of Investment Experience.

How To Find Calculate Principal 401 K Fees

Principal Amount Formula How To Calculate Principal Video Lesson Transcript Study Com

Catch Up Contributions How Do They Work Principal

80 Best Financial Planning Calculators

How To Find Calculate Principal 401 K Fees

Amortization Schedule Calculator Equal Principal Payments

Principal Real Estate Investors Review Smartasset Com

How To Find Calculate Principal 401 K Fees

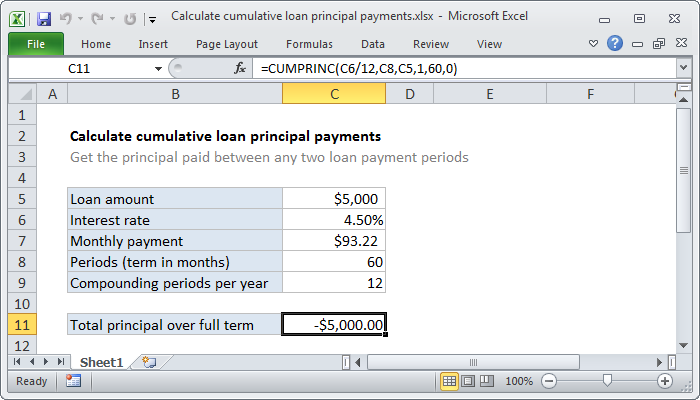

Excel Formula Calculate Cumulative Loan Principal Payments Exceljet

How To Find Calculate Principal 401 K Fees

30 Free Online Financial Calculators You Need To Know About Expensivity

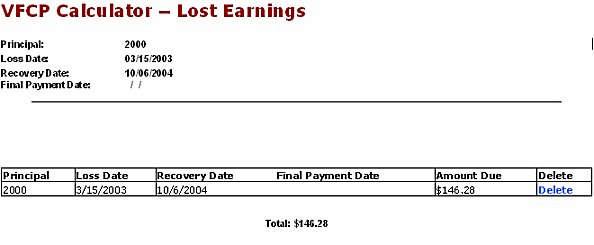

Voluntary Fiduciary Correction Program Vfcp Online Calculator With Instructions Examples And Manual Calculations U S Department Of Labor

How To Find Calculate Principal 401 K Fees

How To Find Calculate Principal 401 K Fees

Extra Principal Payment Calculation Financial Calculator

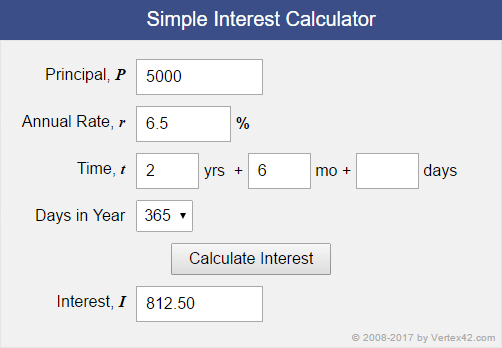

Simple Interest Calculator And Formula I Prt

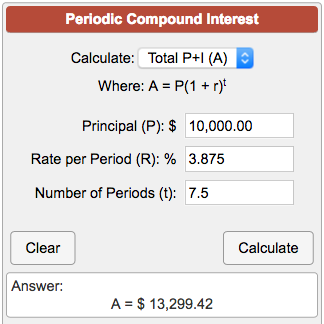

Periodic Compound Interest Calculator